Zenith predicts global ad expenditure will grow 4.1% in 2018, reaching US$578 billion by the end of the year. This forecast is fractionally below the 4.2% rate we predicted for 2018 in September, with marginal downgrades in North America, Western Europe and Asia Pacific, and upgrades in Latin America and Central & Eastern Europe.

We expect advertising expenditure to grow more slowly that the global economy as a whole out to 2020.

Growth of advertising expenditure and GDP 2017-2020 (%)

Source: Zenith/IMF

Forecast for Fast-track Asia:

Fast-track Asia is characterised by economies that are growing extremely rapidly as they adopt Western technology and practices and innovate new ones, while benefiting from the rapid inflow of funds from investors hoping to tap into this growth. Fast-track Asia barely noticed the 2009 downturn (ad expenditure grew by 7.8% that year) and since then has grown very strongly, ending 2016 up an estimated 9.0%. However, the Chinese economy – the main engine of growth in Fast-track Asia – is slowing down after years of blistering growth, and the ad market is slowing alongside it. The extended period of mourning for King Bhumibol Adulyadej has led to a second year of decline for Thailand, and Malaysia’s recovery from the downturn of 2016 has been less rapid than we hoped. We expect ad expenditure in Fast-track Asia to grow 7.6% in 2017, and at an average rate of 6.4% a year between 2017 and 2020. This is less rapid than the growth in Eastern Europe and Central Asia, but Fast-track Asia is ten times larger, so contributes a lot more to global adspend growth.

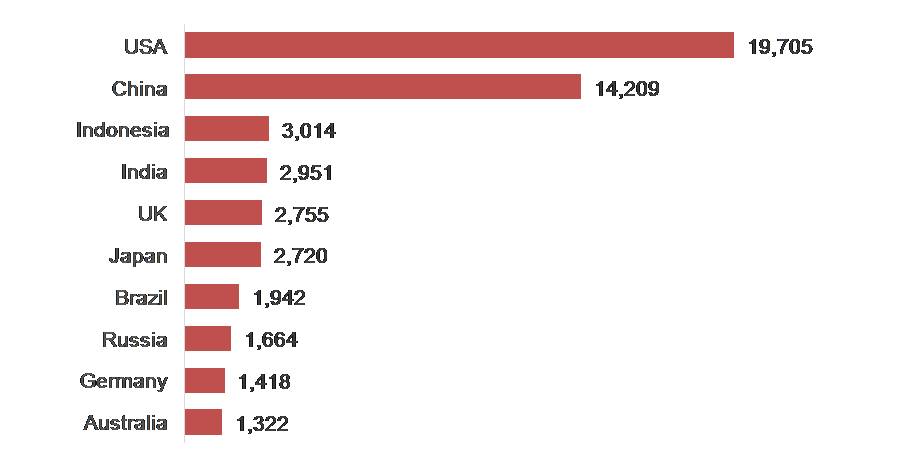

Forecast by leading advertising markets

The US will be the leading contributor of new ad dollars to the global market over the next three years, making up in scale what it lacks in speed. China will come second, combining large scale and rapid growth (though its growth is slowing as its scale increases).

Between 2017 and 2020 the report forecast global advertising expenditure to increase by US$72billion in total. The US will contribute 27% of this extra ad expenditure and China will contribute 20%, followed by Indonesia, India, the UK and Japan, which will contribute 4% each.

Five of the ten largest contributors will be Rising Markets* (China, Indonesia, India, Brazil and Russia), and between them they will contribute 33% of new adspend over the next three years. Overall, we forecast Rising Markets to contribute 54% of additional ad expenditure between 2017 and 2020, and to increase their share of the global market from 37% to 39%.

Top ten contributors to adspend growth 2017-2020 (US$m)

Source: Zenith

The world’s top ten advertising markets by size will remain stable between 2017 and 2020, with only one change in the ranking when Indonesia replaces Canada in tenth place in 2019.

Global advertising expenditure by medium

This year internet advertising has overtaken advertising in traditional television to become the world’s biggest advertising medium, accounting for 37.3% of total ad expenditure. As internet advertising matures, its growth is slowing down, but it remains the fastest growing medium by some distance. We estimate that internet adspend grew 13% year on year in 2017, and we forecast an average growth rate of 10% a year between 2017 and 2020. By 2020 we expect internet advertising to account for 44.3% of global adspend.

Internet adspend by type 2017-2020 (US$ billion)

Source: Zenith

Display is the fastest-growing internet sub-category, with 12% annual growth forecast to 2020. Here we include traditional display (such as banners), online video and social media. All three types of display have benefited from the transition to programmatic buying, which allows agencies to target audiences more efficiently and more effectively, with personalised creative. Online video and social media are currently the driving forces of internet adspend growth: we forecast online video advertising to grow by 17% a year on average between 2017 and 2020, while social media will grow by 16% a year. Online video is benefiting from the increasing availability of high-quality content, and improvements to the mobile viewing experience, such as better displays and faster connections. And for many consumers, checking their mobile devices for social media has become a regular, ingrained habit, while social media ads blend seamlessly into their mobile app newsfeeds. Note that these are not mutually exclusive categories: online video ads are now an important component of social media platforms’ revenues.

Paid search and classified are now both lagging substantially behind display. Search is growing at 8% a year, and classified at 7%.

Looking at internet adspend by device reveals the dramatic ascent of mobile advertising (by which we mean all internet ads delivered to smartphones and tablets, whether display, classified or search, and including in-app ads). We estimate that mobile advertising grew 33% in 2017, after 48% growth in 2016, and we forecast an average annual growth rate of 18% a year between 2017 and 2020, driven by the rapid spread of devices and improvements in user experiences. By contrast we forecast desktop internet advertising to shrink at an average rate of 1% a year as advertisers follow consumers to mobile.

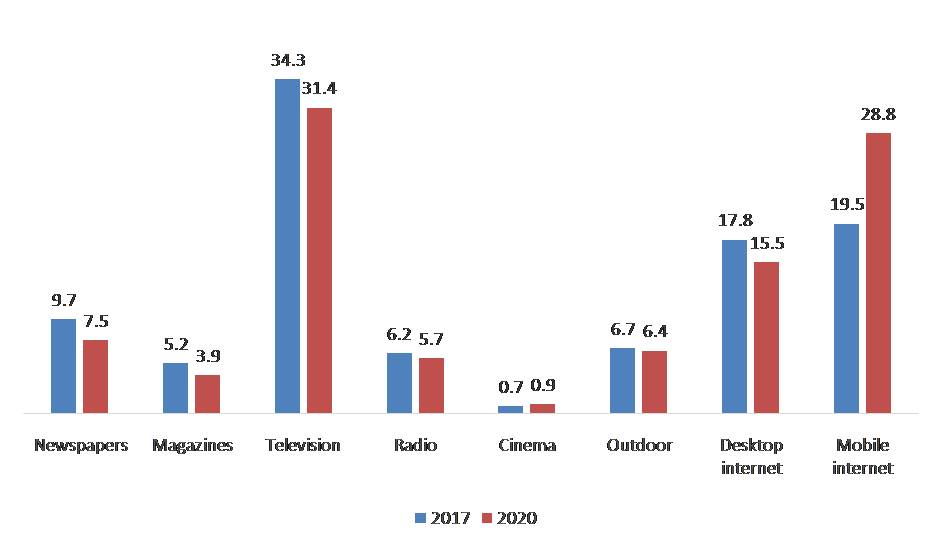

We estimate global expenditure on mobile advertising at US$106 billion in 2017, representing 52.2% of internet expenditure and 19.5% of total advertising expenditure (this total excludes a few markets where we don’t have a breakdown by medium). By 2020 we forecast mobile advertising to have grown to US$176 billion, well ahead of desktop’s US$95 billion total, having overtaken desktop in 2017. Mobile will account for 65.0% of internet expenditure and 28.8% of all expenditure in 2020 – more than all the traditional media except television put together.

Share of global adspend by medium

Source: Zenith

Since it began in the mid-1990s, internet advertising (both desktop and mobile) has principally risen at the expense of print. Over the last ten years internet advertising has risen from 9% of total global spend (in 2007) to 37% (in 2017). Meanwhile newspapers’ share of global spend has fallen from 27% to 10%, while magazines’ has fallen from 12% to 5%. Print titles will continue to lose market share as their readers continue to move to online versions of the print brands or other forms of information and entertainment entirely. We predict newspapers and magazines will shrink at average rates of 4% and 6% a year respectively, ending with respective 8% and 4% market shares in 2020.

Note that our figures for newspapers and magazines include only advertising in printed editions of these publications, not on their websites, or in tablet editions or mobile apps, all of which are picked up in our internet category. The performance of print editions does not describe the overall performance of newspaper and magazine publishers.

Television was the dominant advertising medium between 1996 (when it overtook newspapers with a 37% market share) and 2016 (when it attracted 35% of total advertising expenditure). This year, however, the internet overtook television to become the largest advertising medium. Looking at the ad market as a whole, including search and classified, we think television’s share peaked at 39.3% in 2012, fell to 34.3% in 2017, and by 2020 expect it to fall back to 31.4%, its lowest share since 1981.

However, one of the reasons for television’s loss of share is the rapid growth of paid search, which is essentially a direct response channel (together with classified), while television is the pre-eminent brand awareness channel. Television does not compete directly against search, and indeed the two can complement each other, for example by running paid search activity to take advantage of the increase in searches driven by a television campaign. Taking internet classified and search out of the picture, television will remain the principal display medium for many years to come. We estimate television accounted for 42.6% of display expenditure in 2017, and will attract 40.1% in 2020.

If we consider audiovisual advertising as a whole – television plus online video – we see that it is in fact consolidating its dominant share of display advertising. Television offers unparalleled capacity to build reach, while online video offers pinpoint targeting and the potential for personalisation of marketing messages. Both are powerful tools for establishing brand awareness and associations. We estimate that audiovisual advertising accounted for 48.7% of display advertising in 2017, up from 43.7% in 2010, and expect its share to rise to 49.0% in 2020.

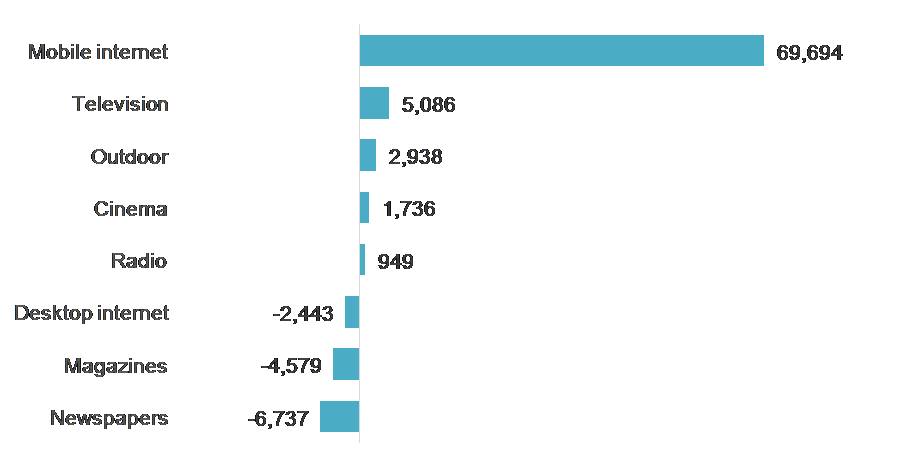

Contribution to global growth in adspend by medium 2017-2020 (US$ million)

Source: Zenith

Mobile is by some distance the main driver of global adspend growth. We forecast mobile to contribute US$70 billion in extra adspend between 2017 and 2020 (again excluding markets where we don’t have a breakdown by medium). Mobile advertising’s growth will be counterbalanced by an US$2 billion decline in desktop advertising, as advertisers switch budgets to mobile, combined with an US$11 billion decline from print. Television and outdoor advertising will be the second and third-largest contributors, growing respectively by US$5 billion and US$3 billion, while cinema and radio grow by about US$2 billion and US$1 billion respectively.